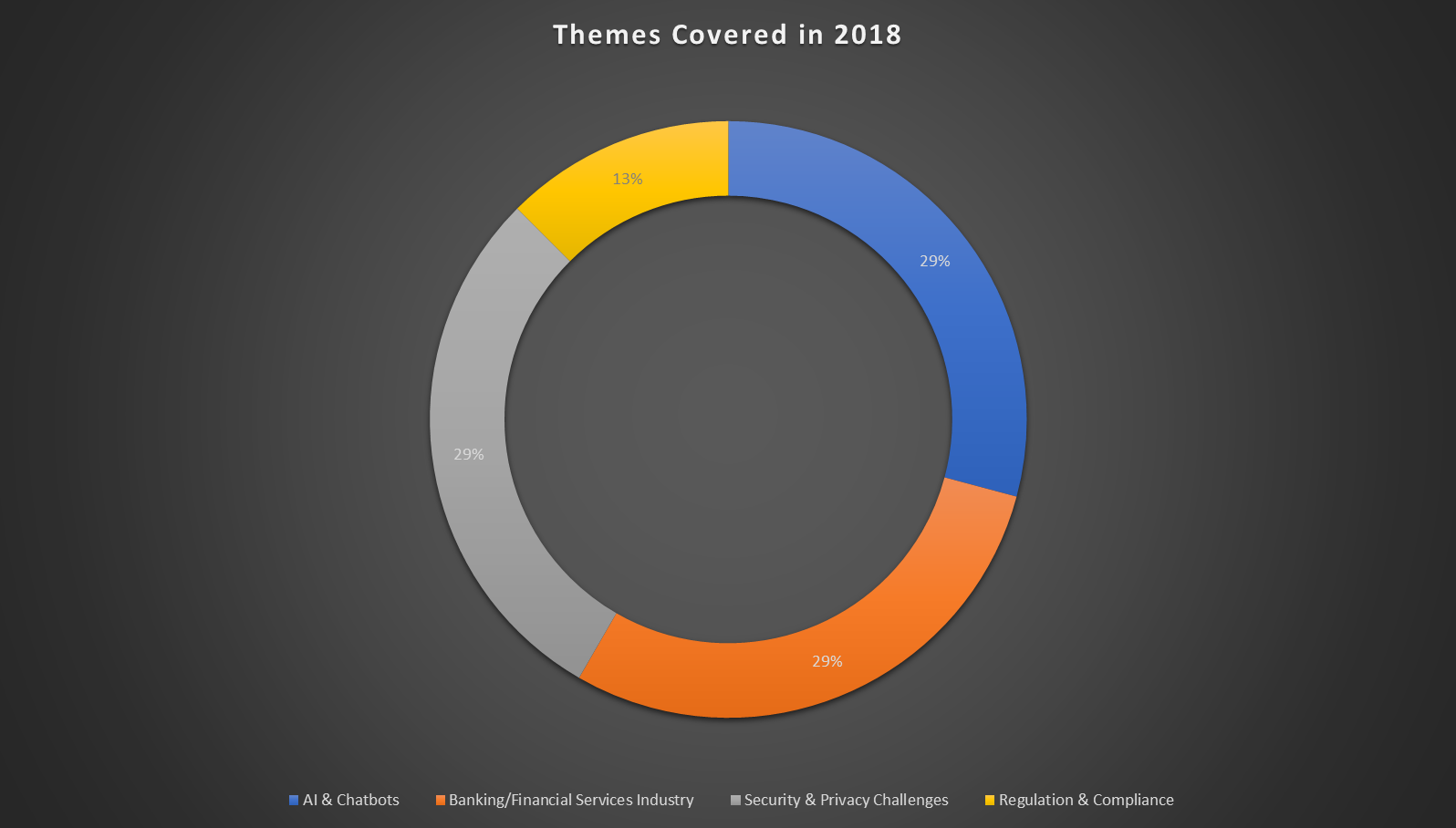

2019 Digital Security and Threats Predictions

As 2018 well demonstrated, the financial services industry is increasingly being disrupted by innovation. 2019 looks to be another exciting year for financial technologies. Changes are occurring in various aspects of the industry and across multiple levels within financial services organisations. Whether it be back-office infrastructure, customer experience, digital transformation, or retail banking, these disruptive innovations are generally aimed at...

Read More