The Business of Stolen Data

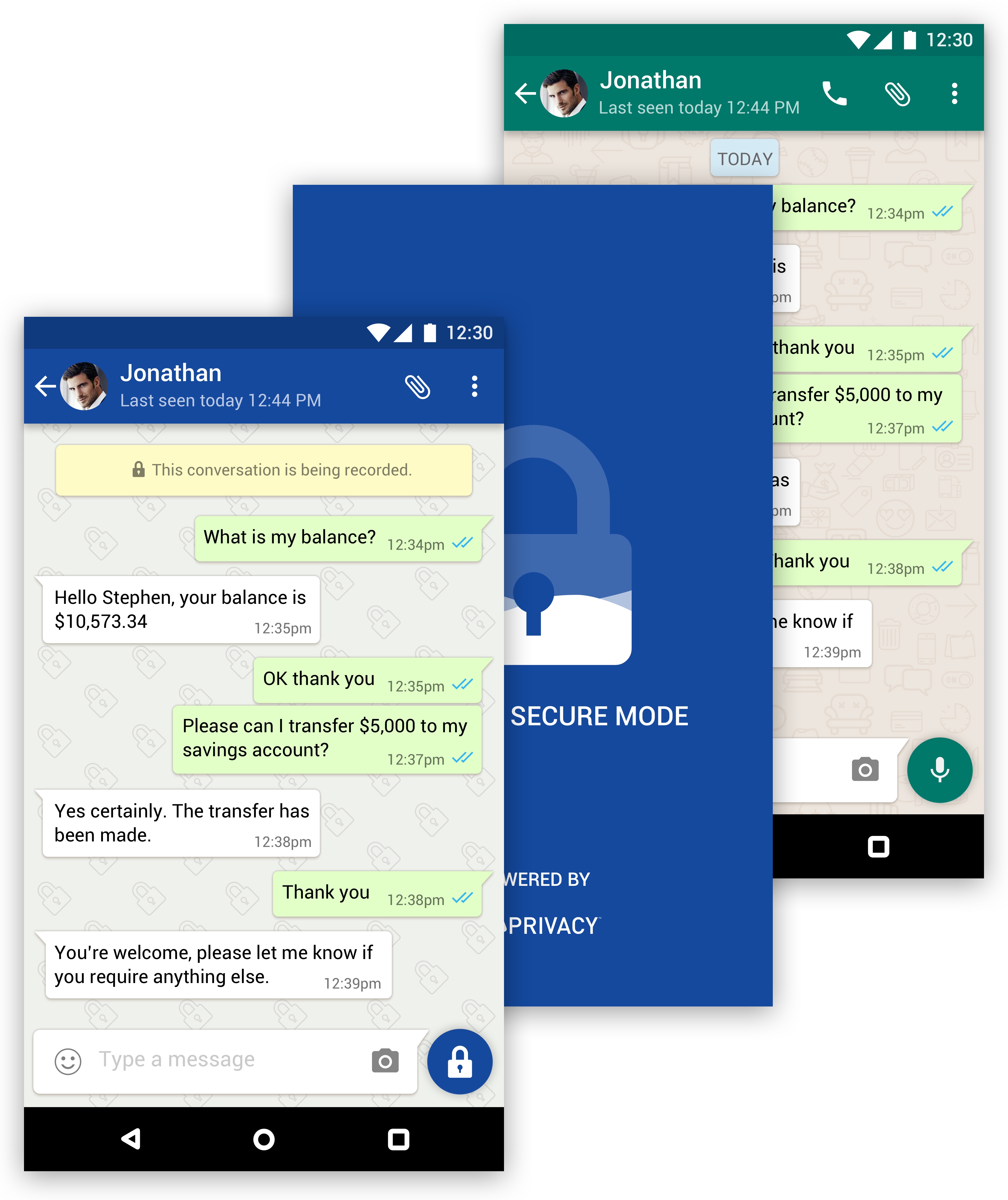

Each day, 2.5 quintillion bytes of data is created. With the arrival of the Internet and connected devices, people rely more and more on technology and as such personal data items are constantly being created, whether it be passwords to access their financial information online or photos to share on social networks....

Read More